Contact Us Now for Tailored Financial Therapy and Solutions

Contact Us Now for Tailored Financial Therapy and Solutions

Blog Article

Why Prioritizing Your Financial Wellness Consists Of Looking For Expert Debt Therapy Solutions for Sustainable Debt Alleviation

Achieving sustainable financial debt alleviation involves even more than just making settlements; it requires a critical technique that deals with the root causes of financial distress. By employing the assistance of professionals in credit history counselling, people can obtain useful understandings, resources, and support to browse their method towards economic security.

Benefits of Specialist Credit Scores Coaching

Engaging in skilled credit rating counseling can offer individuals with tailored monetary strategies to properly take care of and lower their debt worry. By analyzing a customer's economic scenario thoroughly, credit report counselors can develop customized debt management intends that match the person's specific needs and goals.

Additionally, experienced credit therapy services commonly provide beneficial education on financial literacy and finance. Clients can acquire understandings into responsible costs behaviors, financial savings techniques, and lasting preparation for economic security. This expertise equips people to make informed decisions concerning their finances and create healthy financial practices for the future. In addition, credit rating counseling can provide emotional support and motivation during difficult times, helping individuals remain encouraged and devoted to their debt payment trip. Overall, the benefits of skilled debt therapy extend beyond debt relief, aiding individuals build a strong foundation for long-lasting monetary health.

Recognizing Financial Obligation Alleviation Options

When dealing with overwhelming financial obligation, individuals must meticulously assess and comprehend the various offered options for financial debt relief. One common financial obligation relief option is financial debt loan consolidation, where several financial debts are incorporated into a solitary lending with a lower passion price.

Insolvency can have resilient effects on credit score and monetary future. Looking for professional credit counseling services can assist people evaluate their economic situation and establish the most appropriate financial debt alleviation choice based on their specific situations.

Developing a Personalized Financial Plan

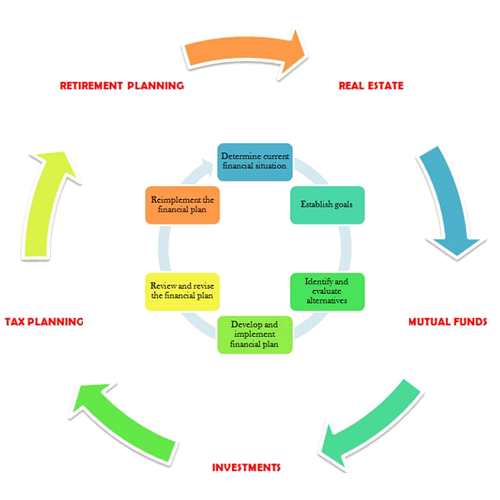

Considering the numerous financial obligation relief alternatives readily available, it is important for individuals to establish a personalized economic strategy customized to their certain conditions. A personalized financial plan offers as a roadmap that lays out a clear course in the direction of achieving monetary security and liberty from debt. To begin developing this plan, individuals must first assess their current financial circumstance, including revenue, expenditures, liabilities, and possessions. This analysis provides a comprehensive understanding of one's financial standing and aids identify areas for enhancement.

Next, setting realistic and certain economic objectives is essential. Routinely keeping an eye on and changing this budget as needed is important to stay on track towards monetary objectives.

Furthermore, seeking professional debt therapy solutions can give useful advice and support in creating an individualized economic strategy. Credit score counselors can provide skilled advice on budgeting, financial obligation administration approaches, and economic planning, assisting individuals make educated decisions to secure a secure monetary future.

Value of Budgeting and Conserving

Effective monetary administration via budgeting and saving is basic to attaining long-term economic stability and success. Budgeting permits individuals to track their income and expenditures, enabling them to focus on spending, identify areas for possible financial savings, and stay clear of unnecessary financial obligation. By creating a budget that aligns with their economic objectives, individuals can efficiently prepare for the future, whether it be developing a reserve, conserving for retirement, or buying assets.

Saving is equally crucial as it supplies a financial safety and security web for unanticipated expenses and assists individuals work in the direction of their financial objectives. In budgeting, essence and saving are foundation methods that equip individuals to take control of their funds, minimize economic tension, and work in the direction of achieving long-term economic protection.

Long-Term Financial Security

Attaining long-lasting monetary stability is a tactical search that demands careful planning and regimented economic monitoring. To protect enduring financial health, individuals need to concentrate on building a strong financial structure that can hold up against this contact form financial variations and unforeseen costs. This foundation consists of developing a reserve, managing financial obligation properly, and investing for the future.

One key element of long-lasting financial security is developing a lasting budget plan that lines up with one's monetary objectives and priorities. By tracking revenue and costs, individuals can make click for source sure that they are living within their means and conserving for future demands. In addition, conserving for retirement is critical in maintaining economic stability over the long-term. Preparation for retired life very early and consistently adding to retirement accounts can assist people protect their financial future.

Conclusion

In verdict, looking for specialist credit history counselling solutions is necessary for attaining sustainable debt alleviation and lasting economic stability. By recognizing financial obligation relief alternatives, establishing a customized monetary strategy, and prioritizing budgeting and conserving, people can efficiently manage their funds and work in the direction of a protected financial future. With the More Info assistance of credit score counsellors, individuals can make educated choices and take proactive steps towards boosting their economic wellness.

An individualized monetary strategy offers as a roadmap that lays out a clear course towards achieving financial security and freedom from financial obligation. In significance, budgeting and conserving are keystone techniques that equip individuals to take control of their finances, minimize financial anxiety, and job in the direction of achieving long-lasting financial safety.

To secure long lasting financial well-being, people have to concentrate on building a strong financial foundation that can endure financial fluctuations and unanticipated expenses - contact us now. By leveraging expert assistance, people can browse monetary difficulties extra efficiently and work in the direction of a lasting financial obligation alleviation plan that supports their long-term financial well-being

Report this page